Tallahassee is a bustling city that attracts many homebuyers and renters every year. If your a real estate investor and planning to purchase a rental property in Tallahassee, you should consider getting a DSCR or debt service coverage ratio loan.

Tallahassee is a bustling city that attracts many homebuyers and renters every year. If your a real estate investor and planning to purchase a rental property in Tallahassee, you should consider getting a DSCR or debt service coverage ratio loan.

DSCR loans are popular among real estate investors because they offer several benefits, but they also have their drawbacks. This post will help you understand everything you need to know about DSCR loans in Tallahassee. It includes the pros and cons of these loans, DSCR loan benefits, lender requirements, and the current real estate rental market in Tallahassee.

What is a DSCR Loan?

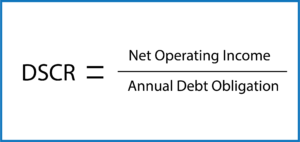

When you apply for a DSCR loan, the lender will look at your credit score, and most importantly the coverage ratio of the property. This is where the debt service coverage ratio (DSCR) comes in. DSCR is a financial metric that measures a property’s ability to generate enough cash flow to cover debt service/mortgage payments. However, the borrower’s personal income and debt-to-income ratios are not required like with conventional loans. This is one of the main attractions of DSCR loans.

How to Calculate DSCR?

DSCR is calculated by dividing the net operating income of the property (NOI) by the total debt service. Leaders and banks typically like to see DSCR at X1.0 -X.1.25 or above. The higher the DSCR, the better terms that will be available. At DSCR Loan Source we have options down to .75 DSCR (Negative cash flow permitted)

Note: When calculating the DSCR, the loan payment (debt service) amount should include Principal, interest, taxes, and homeowners insurance (PITI) plus any HOA dues if applicable. The property management fees, utilities, yard care, etc are not included in this formula.

Example: Real estate investor decides to purchase a rental property in near FSU with a rental income of $2,750 per month and a debt of $2,000 per month. When you divide $2,750 by $2,000, you get a DSCR of X1.375 meaning the rental property generates more income than what is required to repay the loan.

A DSCR ratio of x1.0 indicates that the borrower will have adequate cash flow from the subject property to pay off the loan. If the DSCR ratio is x1.25, the borrower can make loan payments with some extra income. Obviously a higher DSCR provides even greater ROI for the investor. Please read more on the DSCR Purchase Page.

Tallahassee DSCR Loan Benefits:

Tallahassee DSCR Loan Benefits:

- No tax returns, pay stubs, income docs, or employment are needed from the investor for loan qualifying.

- DSCR loans are ideal for real estate investors who want to buy and hold rental properties, both short-term and long-term. First-time investors welcome.

- DSCR loans help investors build equity and create passive income and permit an unlimited number of properties.

- DSCR loans also allow you to refinance your property if you have improved its cash flow.

- Rates and fees are much lower when compared to hard money loan alternatives.

- Close in name of LLC or Corp (not permitted with conventional loans)

- Regular DSCR loans from $75,000 – $1,000,000

- DSCR jumbo loan amounts up to $4 million

- DSCR Cash-out refinance transactions up to $2 million

- Standard rate-term refinance transactions

- Maximum Loan to Value (LTV) is 80% on purchase transactions and 75% for cash-out refinance transactions.

Tallahassee DSCR Loan Restrictions:

Tallahassee DSCR Loan Restrictions:

- Investors must be able to demonstrate a 12-month history of owning a primary residence or an investment property.

- A minimum credit score of 620 is required for DSCR.

- Only investment properties are eligible – no primary or second vacation homes are permitted.

- A pre-payment penalty of generally 5 years, but many have an available 3-year buy-down option.

- Interest rates are higher, typically 1%-2% when compared to conventional loans.

- Investors will need to document cash reserves, generally 3 months.

Current Real Estate Rental Market in Tallahassee:

The current real estate rental market is strong for both short-term and long-term rentals. The median rent in Tallahassee is $1,599 per month, and the median sales price for a home is $256,000 according to Redfin. The average sales price for the state of Florida is just over $400,000, so Leon County remains well below this. There is a high demand for student housing near Florida State University and Florida A&M University. Long-term rentals are also in high demand in Leon County, especially in popular neighborhoods such as Mid-Town and Killearn.

Conclusion:

DSCR loans offer a great opportunity for real estate investors who want to purchase rental properties in Tallahassee. They allow you to benefit from the cash flow potential of the property and make passive income. While they have certain disadvantages, the benefits of DSCR loans often outweigh the cons for those who want to invest in real estate. This is especially true for investors that have trouble documenting their income or meeting the DTI restrictions for conforming loans.

Before applying for a DSCR loan, make sure to research lenders and their terms, and evaluate the potential cash flow of the property. Overall, DSCR loans are a great financing option that can help you achieve your real estate investment goals. Want to learn more? Please call us 7 days a week or just submit the Quick Call Form on this page for rapid service.