DSCR stands for Debt Service Coverage Ratio. This no-income verification loan qualifies investors through the rental properties cash flow rather than the borrower’s income like standard mortgage programs.

DSCR stands for Debt Service Coverage Ratio. This no-income verification loan qualifies investors through the rental properties cash flow rather than the borrower’s income like standard mortgage programs.

Many self-employed borrowers have complex income streams and DSCR loans solve the problem of having to document income for qualifying. DSCR purchase loans are great for RE investors who cannot or do not want to provide income documentation often required for regular conforming bank loans. Tax returns, paystubs, W2s, and employment are not needed allowing for streamlined loan approvals and fast closings.

DSCR can also be beneficial for investors that have a large number of rental properties since many standard conventional loans from banks and credit unions limit this to ten.

In addition, experienced investors often prefer to borrow through their LLC or corporation to protect their other assets. Doing this adds another layer of protection to their personal investments for any unforeseen incidents that could arise. Conventional loans can only be obtained in an individual(s) name

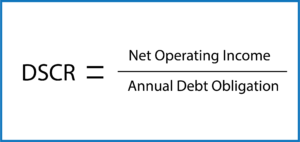

How to Calculate DSCR?

DSCR is calculated by dividing net operating income (NOI) by the total debt service. Leaders typically like to see DSCR at 1.0 or above. At DSCR Loan Source we have options down to .65 DSCR (Negative cash flow permitted)

Note: When calculating the DSCR, the mortgage payment amount should include Principal, interest, taxes, and homeowners insurance (PITI) plus any HOA dues if applicable. Property management fees, utilities, lawn care, etc are not included in this formula.

Example: A real estate investor decides to purchase a rental property in Jacksonville, FL with a monthly rental income of $3,750 and a monthly loan debt of $3,000. When you divide $3,750 by $3,000, you get a DSCR of x1.25, meaning the rental property generates 25% more income than what is required to repay the loan.

A DSCR ratio of 1.0 indicates that the borrower will have adequate cash flow from the subject property to pay off the loan. If the DSCR ratio is 1.25, the borrower can make loan payments with some extra income. Obviously as the percentage goes higher it provides even more ROI for the borrower. Again, lenders typically require a minimum DSCR ratio of 1.0 to process your DSCR loan, at DLS we provide options down to x0.65

DSCR Loan Benefits Include:

DSCR Loan Benefits Include:

- Rates and fees are much lower when compared to hard money loan programs

- Unlimited number of properties

- Close in name of LLC or Corp (not permitted with conventional loans)

- No tax returns, pay stubs, income docs, or employment is needed

- Regular DSCR loans from $75,000 – $1,000,000

- DSCR jumbo loan amounts up to $4 million

- DSCR Cash-out refinance transactions up to $2 million

- Standard rate-term refinance transactions

- Maximum Loan to Value (LTV) is 80% on purchase transactions and 75% for cash-out refinance transactions

- Hard money refinance eligible

- Single Family Homes, Condominiums, and 2-8 unit multifamily homes are all eligible for financing. Short-term rentals like Airbnb, VRBO, etc.

- Gift funds are eligible, but investors should have at least 5% of their own money in the transaction

- First Time investors are eligible

- No hard credit pulls

- 30 and 15 Year fixed interest rate along with all the common 5/7/10 year ARM options

- Interest Only (IO) is available

- 2-1 buydown interest rate feature available

2024 DSCR Loan Restrictions:

2024 DSCR Loan Restrictions:

- Must be able to demonstrate a 12-month history of owning a primary residence or an investment property. First-time investors welcome.

- A minimum credit score of 620 is required for DSCR

- Only investment properties are eligible – no primary or second vacation homes are permitted

- Non-warrantable Condo financing is available on a case-by-case basis

- Most standard DSCRs have a pre-payment penalty, with an available buy-down option. However, new options are now available without a pre-payment penalty for investors who meet the qualifying requirements.

- Interest rates are higher, typically 1%-3% when compared to conventional loans

- Investors will need to document cash reserves, generally 2-6 months

How to Get Approved For DSCR Loan:

The approval process is simple starting with an initial consultation that often takes less than 15 minutes. Helpful information to have in advance:

- The current market value of the property

- Estimated monthly rental income

- Taxes, insurance, and HOA amount (if applicable)

- Closing preference – Individual or LLC

- Down payment amount

Please connect with us 7 days a week by calling Ph: 888-502-1825 or get started here