DSCR loans have become pretty attractive in recent years for Orlando real estate investors purchasing long-term or short-term rental properties. DSCR programs offer competitive rates and terms, but without the documentation hassles of many conventional loans. Let’s look at the Orlando DSCR overview for investors and break down the important details.

DSCR loans have become pretty attractive in recent years for Orlando real estate investors purchasing long-term or short-term rental properties. DSCR programs offer competitive rates and terms, but without the documentation hassles of many conventional loans. Let’s look at the Orlando DSCR overview for investors and break down the important details.

With Orange County’s local attractions and high tourist occupancy rates throughout the year, it is no surprise why so many investors are choosing the Orlando area as a place to invest. Whether you are an experienced investor or just starting out, DSCR cash flow loans provide great flexibility to make it happen.

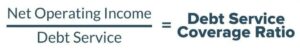

Obviously, the big draw for DSCR mortgages is the reduced documentation requirements. Many investors find documenting income and meeting strict debt-to-income ratio requirements with conforming loans to be an issue. DSCR loans do not require income documentation from the investor in order to qualify. This means no tax returns, pay stubs, or even employment history is needed to get approved. Instead, lenders and brokers look at the property’s cash flow and Debt Service Coverage Ratio.

Have questions? Investors that need assistance can contact us 7 days a week.

Coverage ratios are simply the monthly operating income/rent divided by the monthly debt service payment. Generally, most lenders and brokers prefer coverage ratios at X1.0, and anything X1.25 or above is considered a good DSCR. We now offer new options down to 0.65% (negative cash flow) in 2024. Please review the DSCR Purchase Page for more insight.

Example: The investor is purchasing a long-term rental home in the Winter Park area. The monthly rental income will be $2,800 per month. The monthly expense with the principal, taxes, and homeowners insurance (PITI) will be $2,500 per month. In this example, the coverage ratio is 1.12

Orlando DSCR Loan Benefits:

- No Property Limit – Standard conforming loans will generally limit the number of properties that can be financed. In addition, these properties often cannot be closed under an LLC. Neither of these restrictions applies to DSCR loans.

- Lower Interest Rates – DSCR loans generally have significantly lower interest rates than other “hard money” offerings investors often use.

- Flexible Repayment Terms – With DSCR loans, you can structure your payments to fit your budget and cash flow needs. Investors can choose between fixed or adjustable interest rates, along with interest-only options depending on their needs

- Flexible Refinance Options – DSCR can provide a great refinance solution for investors currently in a short-term hard money loan. In addition, cash-out refinance options up to 75% LTV are useful for reinvesting in new properties.

- Easier Funding – Thanks to reduced documentation and streamlined approvals, DSCR loans can often be funded in just a few weeks.

Please reach out and connect with us by calling the number above, or just submit the Quick Call Form here.

We are glad to assist investors across Florida including Orange, Osceola and Seminole County: Kissimmee, Saint Cloud, Celebration, Altamonte Springs, and Winter Garden.