DSCR loans are a great way for real estate investors to finance rental properties in the Naples, Collier County area. With increased regulations on traditional financing for investment properties, these loans provide an alternative way for investors to secure their financing quickly with minimum hassle. In this Naples real estate investor DSCR loan guide, we will discuss some of the market trends and the benefits of Debt Service Coverage Ratio (DSCR) mortgages.

DSCR loans are a great way for real estate investors to finance rental properties in the Naples, Collier County area. With increased regulations on traditional financing for investment properties, these loans provide an alternative way for investors to secure their financing quickly with minimum hassle. In this Naples real estate investor DSCR loan guide, we will discuss some of the market trends and the benefits of Debt Service Coverage Ratio (DSCR) mortgages.

Investors that have questions can connect with us 7 days a week by calling or submit the Quick Call Form.

Like many parts of Florida, Naples has remained an attractive location for investors with its growing population and booming tourism industry. Naples provides a good rental market for both long-term and short-term Airbnb-VRBO properties. The increased demand has contributed to rising home prices, further incentivizing investors to purchase new properties.

Fortunately, DSCR loans provide a great way for real estate investors to leverage their investments without having to worry about stringent conforming mortgage regulations and excessive paperwork. DSCR loans provide an opportunity for investors to purchase properties, even if they are unable to qualify for a traditional loan. The DSCR loan process is relatively simple and straightforward, helping investors close their deals quickly.

So What is a DSCR Loan?

So What is a DSCR Loan?

DSCR loans are a type of non-qm loan specifically designed for real estate investors. This type of loan is also known as a debt service coverage ratio loan, and it is used to finance the purchase or refinance of an income-producing property. DSCR loans require that borrowers have access to sufficient cash flow in order to meet their debt payments and other expenses associated with owning and operating a rental property.

Conventional investor bank loans require investors to qualify based on their personal income and debt ratios. That’s not the case with DSCR loans, borrowers will NOT provide income or employment documents like tax returns, pay stubs, etc. This can be especially helpful for investors that are self-employed. Instead, the debt service coverage ratio (DSCR) is the key factor that lenders use when determining whether to approve a loan application. Generally, your DSCR must be at least X1.0 to qualify for this type of loan. However, new options have entered the market that includes negative and even zero DSCR qualifying.

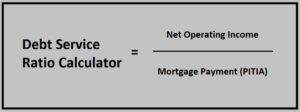

How is the DSCR Factor Determined?

The DSCR factor is determined by taking the net operating income of a property and dividing it by the total debt service of the loan. This ratio then gives lenders an indication of how much cash flow is available to cover loan payments, as well as other costs associated with owning a rental property.

For example, if your monthly rental income is $2,000 and your total monthly expenses including loan payments are $1,500, your DSCR would be 1.33 ($2,000/$1,500). This means that there is extra income above the loan payment amount which could be used to cover other costs associated with owning a rental property such as principal, interest, taxes, and insurance. Monthly service fees, cleaning fees, utilities, etc are not included in this formulation.

It’s important to note that lenders will often look at different factors in addition to the DSCR when determining whether or not a loan will be approved. These include the borrower’s credit score, down payment, property location, and other factors.

Naples DSCR Rental Loan Benefits:

Naples DSCR Rental Loan Benefits:

DSCR investor rental loans offer a number of benefits to investors that include:

- Easier qualification requirements – DSCR loan requirements are typically lower than those for traditional bank loans by eliminating personal income requirements.

- Investors can close in the name of their LLC.

- Flexible terms – DSCR loans often come with flexible repayment terms, allowing investors to tailor their loans to fit their specific needs.

- Regular rate-term and cash-out refinance options – great for investors that need to refinance out of a short-term hard money loan.

- Interest-only repayment terms are available.

- Faster approval times – Unlike traditional loan applications which can take months to process, DSCR loans can be approved quickly—often within days.

Please read the DSCR Purchase page for the down payment and credit requirements.

Naples Real Estate Market Trends:

The Collier County area has seen a surge in population growth in recent years, driving up demand for housing. This has made it a great place to invest in rental properties, as there is no shortage of potential tenants.

In addition to the strong rental demand, Naples has also seen a surge in home values. This is great news for investors, as it means their investments are likely to appreciate in value over time. Even with the market slightly cooling in recent months, prices are still up year over year. The current median home price in Naples is $670,000.

Overall, the Naples real estate market, with its favorable economic climate and booming population growth, is an attractive option for investors looking to secure financing through DSCR investor loans.

Investors should, however, take the time to do their due diligence before investing. They should research local laws and regulations regarding rental properties and consult with a real estate professional. By taking these steps, they can ensure their investment is profitable and secure.

Questions? Please connect with us today by calling Ph: 888-502-1825 or just submit the Quick Call Form for expedited service.