DSCR loans have become increasingly popular for Miami investors as a method of financing both long-term and short-term Airbnb rental purchases. DSCR mortgages come with both good and bad qualities that investors should be aware of when evaluating the right financing option. Let’s take a quick look at some of the DSCR benefits and drawbacks investors should know.

DSCR loans have become increasingly popular for Miami investors as a method of financing both long-term and short-term Airbnb rental purchases. DSCR mortgages come with both good and bad qualities that investors should be aware of when evaluating the right financing option. Let’s take a quick look at some of the DSCR benefits and drawbacks investors should know.

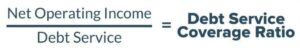

DSCR, or Debt Service Coverage Ratio, is a metric used by lenders to determine borrowing risk. This type of loan focuses more on the rental property cash flow rather than the investor’s personal income. Many investors are aware that regular conforming bank loans require full income documentation in order to be approved. In addition, these loans also have stringent debt-to-income ratio limits in place.

This can often pose an issue for self-employed investors with complex tax returns that don’t necessarily reflect a true picture of their income. DSCR is great for investors that want to purchase a rental property but don’t meet the traditional income documentation required by regular bank loans.

With DSCR, the main focus is the borrower’s credit score and coverage ratio of the rental property. Most lenders like to see a minimum 1x debt service coverage ratio, meaning the rent or net operating income (NOI) is enough to cover the debt service obligation. However, new options now permit negative coverage ratios below 1x with greater down payments, please see the DSCR Purchase Page for more details.

*Coverage ratio formulations should only include principle, interest, taxes, and insurance (PITI) plus any HOA fees if present.

Miami DSCR Loan Benefits:

Miami DSCR Loan Benefits:

- Easier to qualify, fewer requirements than traditional mortgages. No personal income is needed to qualify. No tax returns, pay stubs, W2s, or even employment.

- Financing options are available down to a 620 credit score.

- No advance lease is required, we can use Market Rent (1007) from the appraisal.

- Faster closing times.

- Flexible fixed rates and adjustable rate terms are available with an interest-only repayment option.

- Close in the name of LLC or Corp (Not permitted with a conventional loan)

- Long-term and Short-term VROB -Airbnb permitted.

- Purchase transactions up to 80% loan to value.

- Cash-out refinance transactions up to 75% LTV (No 12-month seasoning requirement like conventional loans)

- Hard money refinance eligible – DSCR refinance is great for those investors that need to refi out of a short-term hard money loan.

- Gifts are permitted for the down payment *subject to terms.

- DSCR Jumbo loan amounts to $2m+ available.

Miami DSCR Loan Drawbacks:

Miami DSCR Loan Drawbacks:

While DSCR loans present numerous benefits, there are also some drawbacks investors should be aware of.

- Interest rates on DSCR will average 1.5%-2% percentage points higher than conforming investor loans, but still much lower than hard money alternatives.

- DSCR loans do have a pre-payment penalty generally for 5 years, but with the option to reduce it to 2-3 yrs.

- The borrower will have to document bank statements to show reserves. The reserve requirements can vary based on the loan amount, LTV, etc. Generally, 3-6 months of reserves are customary.

- DSCR is only for investment rental properties only, not vacation homes.

The current rental market in Miami-Dade presents numerous opportunities for property investors looking to take advantage of DSCR loans in 2024. With flexible terms and minimal documentation, DSCR loans are becoming an increasingly popular financing option for real estate investors in South Florida.

We are happy to serve investors throughout Fla including Miami, Fort Lauderdale, and Key West. Want to learn more? Please connect with us by calling or just submit the Quick Call Form to learn more.