Many investors in Jacksonville are familiar with Debt Service Coverage Ratio Loans (DSCR) and some of the benefits they provide. DSCR mortgages really started to gain popularity in recent years due to their qualifying flexibility. Duval County has remained a strong rental market with nearly 30% of all homes sold to investors.

Many investors in Jacksonville are familiar with Debt Service Coverage Ratio Loans (DSCR) and some of the benefits they provide. DSCR mortgages really started to gain popularity in recent years due to their qualifying flexibility. Duval County has remained a strong rental market with nearly 30% of all homes sold to investors.

How 2024 turns out will greatly depend on mortgage interest rates and home price trends. Many industry experts think that interest rates have likely peaked, and actually decreased some since their high levels last year. Borrowing cost is obviously one of the most important factors for investors and determining coverage ratios.

Jacksonville DSCR Loan Benefits:

The primary benefit of DSCR loans is that they are much easier to qualify for when compared to standard conforming bank loans. With traditional loan applications, lenders often require extensive financial documents such as profit and loss statements, tax returns, etc. This makes it difficult for many businesses to qualify due to their lack of these documents or because their records may not accurately reflect their current income situation.

In contrast, DSCR loans are primarily based on the rental property cash flow and not the borrower’s income. No tax returns, income documents, or employment history are needed to qualify.

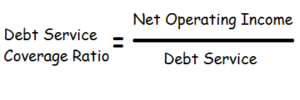

DSCR is a financial metric used to measure whether the cash flow generated from a rental property can cover its debt obligations. The standard to qualify is a property must usually demonstrate “1x” coverage which means they have to generate at least one dollar of cash flow per each dollar owed on the loan repayment schedule. However, we now offer new options that permit down to 0.65% coverage ratios – negative cash flow is permitted.

Coverage ratios include the principal, interest, tax, and insurance (PITI) plus any homeowners association fees. Monthly utility or maintenance fees are not included. Learn more about coverage ratio calculations on the DSCR Purchase Page.

Another key benefit of DSCR cash-flow loans is that they often offer lower interest rates than hard money type programs. DSCR loan interest rates typically average 4-6% less than comparable hard money mortgages. Depending on the lender and borrower’s circumstances, DSCR can be significantly lower than most other types of investor loans.

Additionally, DSCR mortgages are often available up to 80% loan to value. Many traditional lending programs usually require a greater down payment and more documentation. This makes it an attractive option for entrepreneurs who don’t have access to assets that could be used as collateral in order to secure a loan from a conventional lender.

DSCR cash-out refinance provides a valuable tool for investors to strip equity, or pay off a short-term hard money loan coming due. Cash-out refinance options are available up to 75% LTV for qualified Jacksonville investors.

Whether you are looking for a DSCR cash-out refinance, a long-term rental, or a short-term Airbnb -VRBO rental, contact DSCR Loan Source 7 days a week to review your options. Call us at the number above or just submit the Quick Call Form