DSCR loans offer convenience for many real estate investors in Fort Myers & Cape Coral that are looking to access capital quickly and easily. DSCR financing can be a valuable tool when purchasing both long-term and short-term Airbnb rental properties. Even with recent moderation in real estate, the housing market in Lee County continues to show signs of strength with the current median home sold price around $375,000. Both long-term and short-term vacation rental properties make up a large percentage of these recent sales in 2024.

DSCR loans offer convenience for many real estate investors in Fort Myers & Cape Coral that are looking to access capital quickly and easily. DSCR financing can be a valuable tool when purchasing both long-term and short-term Airbnb rental properties. Even with recent moderation in real estate, the housing market in Lee County continues to show signs of strength with the current median home sold price around $375,000. Both long-term and short-term vacation rental properties make up a large percentage of these recent sales in 2024.

Today we highlight the following:

1. What is a DSCR loan and what are the benefits of using one –

2. How do you qualify for a DSCR loan –

3. What are some of the restrictions on DSCR loans –

4. How to get the best terms on a DSCR loan –

Fort Myers DSCR Loan Benefits:

Debt Service Coverage Ratio (DSCR) loans are unique in that the lender looks at how much rental income (cash flow) the property can generate. This is the primary component that is used to determine eligibility, unlike personal income and DTI ratios like conventional bank loans. Most investors are self-employed and like many 1099 borrowers documenting income can be a big challenge when it comes to mortgage approval.

DSCR loans do not require employment history, tax returns, pay slips, W2s, or any income documents. This means that investors with lower incomes may still qualify for the loan. The end result is a more streamlined approval and faster closing times.

- DSCR loans do not have loan “seasoning requirements” like conventional loans. This is especially good for refinance transactions as many standard loan options require 12 months of loan seasoning.

- No limit on the number of properties – conventional loans often limit this to 10 active loans.

- Ability to close in the name of LLC or Corp – often not possible with regular conforming products.

- New first-time investors are eligible.

- Short-term hard money cash-out refinance transactions are eligible.

- Terms extend to 40 years with interest-only options.

Qualifying For DSCR Loan:

- Credit Score: Investors with a credit score down to 620 are eligible. However, for the maximum financing of 80%, the borrower should maintain credit over 720.

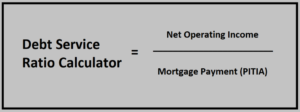

- Cash Flow and DSCR calculation: Calculating the DSCR is simply done by dividing the debt service payment amount / rental amount.

- The property should cash flow 1x in most cases. However, new options are available for negative cash flow down to 0.75 for those investors that have a greater down payment.

Example: The investor wants to purchase a long-term rental that will generate $2,500 per month in income. The debt service (payment) is $2,000 per month. In this case $2,500/$2,000 = x1.25 DSCR. 1.25 is considered a great DSCR for most lenders. Please learn more on the DSCR purchase page.

Fort Myers DSCR Loan Restrictions:

- The interest rates on DSCR loans can be a few percentage points higher when compared to conforming loans.

- Only investment properties are eligible.

- Rural classified properties will require greater down payments – generally 30% down.

- Mortgage payment reserves will be required. Generally 3 months, but the exact amount will depend on credit, LTV, DSCR, etc.

- DSCR loans will have an early payoff penalty – generally five years, but can often be reduced to three years.

- It is important to note that you will need a FICO score of 620 or higher.

Best Terms on DSCR Loan:

Best Terms on DSCR Loan:

The interest rate, terms, and options are based on risk, just the same as any other mortgage. For DSCR, the higher the credit and coverage ratio, the lower the risk to the lender. Those investors that have great credit, ratios exceeding 1.25, and LTV under 70% are generally rewarded with the most flexibility and lowest rates.

Contact us today to learn more about DSCR in Southwest Florida. We are happy to serve Bonita Springs, Cape Coral, Ft. Myers, Estero, and Lehigh Acres.