Fort Lauderdale continues to grow and remains a hot spot for real estate investors and both long-term and short-term Airbnb rentals continue to expand. Broward County is now the 2nd most populous county in Florida with nearly two million residents in 2024. Not only is the area a great place to vacation, but also to live with plenty of job opportunities, entertainment venues, and educational resources.

Fort Lauderdale continues to grow and remains a hot spot for real estate investors and both long-term and short-term Airbnb rentals continue to expand. Broward County is now the 2nd most populous county in Florida with nearly two million residents in 2024. Not only is the area a great place to vacation, but also to live with plenty of job opportunities, entertainment venues, and educational resources.

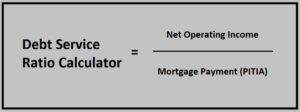

DSCR loans have gained a lot of popularity in recent years with investors due to the ease of qualifying. DSCR (Debt Service Coverage Ratio) loans don’t have many of the qualifying restrictions as standard conforming loans. Instead of relying on personal income, they look at the ratio of rental income to debt payments. This lenient approach has made them attractive to investors who want to purchase multiple properties or take advantage of a great deal with limited resources.

Qualifying for a DSCR Loan in Fort Lauderdale:

There are several factors that must be taken into consideration. Again, the Debt Service Coverage Ratio (DSCR) is the key factor used by lenders when evaluating investors for a loan. This ratio measures the ability of the borrower to repay their debt based on their current income versus all existing debts and expenses. A lender typically will not approve an application if the DSCR falls below X.075 or X1.0, as this indicates that they may have difficulty covering the debt service.

Example: Let’s say investor Brian is purchasing a long-term rental home in the Harbor Beach area. The monthly rental income will be $4,200 per month. The monthly expense with the principal, taxes, and homeowners insurance (PITI) will be $3,500 per month. In this example, the coverage ratio is X1.2

DSCR Loan Benefits For Florida Investors:

- No Income Or Employment Docs: DSCR purchase loans are especially helpful for self-employed investors that have difficulty documenting the income needed for a conventional bank loan. Standard conventional loans will require income documentation like tax returns and W2s in order to qualify. Buyers must also meet the strict debt-to-income ratio limitations. No income or even employment documentation is needed to qualify for a DSCR mortgage.

- Close LLC: With DSCR loans investors can close in the name of their LLC, this is something that is not permitted in most conforming loans.

- Fast Closings: DSCR loans can often close in less than two weeks, which is much faster than a conventional loan.

- Lower Interest Rates: One of the most significant benefits of DSCR loans is that they often come with lower interest rates compared to other “hard money” types of loans many investors use. DSCR loans have been designed to provide funding for extended periods as well, so the interest rates align with these long periods. The lower interest rates allow real estate investors to save money on their investments, allowing them to allocate more resources to the property itself.

- Higher Loan Amounts: Another benefit of DSCR loans is that they typically offer higher loan amounts. Unlike traditional home loans, which are capped by the value of the house, DSCR loans are determined by the cash flow of the property. In other words, a DSCR loan will not be limited by the value of the property, but instead by the cash flow the property generates. This enables real estate investors to secure financing for larger and more expensive properties.

- DSCR Refinance: Investors have many options to refinance out of a short-term fix & flip hard money loan, or cash-out refinance for BRRR. Learn more about DSCR Refinance Options here.

In conclusion, DSCR loans are an excellent financing option for investors seeking to finance their rental properties. They present many benefits compared to other loans, including reduced documentation and faster closing times. It’s essential that real estate investors consider all loan options available. If you want to learn more about DSCR, please connect with us 7 days a week by calling or submit the Quick Call Form