Real estate investing in short-term and long-term rental properties in Birmingham has quickly become appealing for many investors and with good reason. Investment in real estate can be incredibly lucrative, with returns often being dependent upon the location of the property.

Real estate investing in short-term and long-term rental properties in Birmingham has quickly become appealing for many investors and with good reason. Investment in real estate can be incredibly lucrative, with returns often being dependent upon the location of the property.

If you are interested in investing in real estate in Alabama, it is important to understand the various options available for financing. One viable financing option for investor rental property is the Debt Service Coverage Ratio (DSCR) loan. In this blog post, we’ll explore the benefits, requirements, and potential downsides of DSCR rental property loans for Birmingham investors.

Real Estate Market in Birmingham:

Birmingham’s short-term rental market has remained strong, thanks to the city’s many cultural attractions, such as the Birmingham Zoo, Vulcan Park and Museum, and the Alabama Sports Hall of Fame. Additionally, the longer-term rental market remains strong, thanks to the city’s many colleges and universities, such as Birmingham-Southern College and Samford University.

The median home price in Birmingham, is around $182,000, making it an excellent city for real estate investment. Investors can search for properties they can purchase at a reasonable rate and turn them into rental properties.

What is a DSCR Loan?

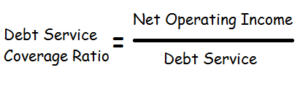

A Debt Service Coverage Ratio (DSCR) loan is a type of loan designed to finance investor rental properties. It can be used for both long-term and short-term Airbnb and VRBO rentals. This type of loan is typically used when the borrower lacks sufficient income or documentation that is required to meet strict debt-ratio requirements for a conventional bank mortgage.

Instead, DSCR lenders focus on the investor’s credit history and mainly the cash flow of the property itself. The borrower’s income and employment history are not considered in the application process.

Generally, any coverage ratio over x1.25 is considered good for most lenders. However, investors with strong down payment and credit can oftentimes qualify for negative cash-flow DSCR options down to x.075%

Example: let’s say Investor Joe wants to purchase a long-term rental property in the Glen Iris area of Birmingham. His monthly payment (PITI) is $3,000 per month. Joe rents the property for $3,750 per month. In this case, Joe’s DSCR would be x1.25% – Joe is making enough rental income to cover his debt service, plus an additional $750 per month.

Birmingham DSCR Loan Requirements:

Birmingham DSCR Loan Requirements:

- To qualify for a DSCR loan, investors should have at least a 620 credit score.

- Borrowers should be able to properly document mortgage payment reserves – generally three months’ worth as a minimum.

- DSCR down payment requirements start at 20% and can vary depending on the investor’s credit profile and coverage ratio of the rental property.

- Only investment properties are eligible, primary or second vacation homes are not permitted

Read more about the complete DSCR Purchase Requirements here.

Pros of DSCR Loans:

- There is no limit on the number of active DSCR loans you have. Many conforming loans limit this to (10)

- Loan amount limits of $4m +

- DSCR loans can provide cash flow that allows investors to purchase additional properties.

- No income or employment documentation. This includes no tax returns, W2s, etc.

- Close in the name of your LLC.

- Assorted cash-out refinance options are available, great for investors that need to refi out of a short-term hard money loan.

- Quick closings often happen in a few weeks.

Cons of DSCR Loans:

- DSCR interest rates are generally a few points higher when compared to conventional loans.

- Most DSCR loan options come with a pre-payment penalty of 1-3 years.

- Minimum loan amount of $100,000

- You need a reliable and stable market environment to ensure consistent rental income.

DSCR mortgages can be an excellent financing option for investors looking to purchase rental properties in Birmingham but have difficulty with the documentation requirements of conventional loans. This is a viable option for both novice and experienced investors.

Before committing to a DSCR loan, you must understand the specific requirements, benefits, and downsides to create a sound real estate investment plan. DSCR Loan Source is here to help answer questions 7 days a week. Please call the number above, or just submit the Quick Call Form here.