DSCR loans provide a valuable niche for Atlanta real estate investors that want to purchase or refinance a rental property with little hassle. A Debt Service Coverage Ratio (DSCR) mortgage is designed for qualified real estate investors who own and operate long-term or short-term vacation rentals such as Airbnb or VRBO.

DSCR loans provide a valuable niche for Atlanta real estate investors that want to purchase or refinance a rental property with little hassle. A Debt Service Coverage Ratio (DSCR) mortgage is designed for qualified real estate investors who own and operate long-term or short-term vacation rentals such as Airbnb or VRBO.

Flexibility and quick closing times are just part of the appeal of DSCR. In this quick review, we look at the benefits of DSCR so investors can better decide what financing options work best for them.

During the past few years, investors have accounted for nearly 1/3 of all single-family purchases in Atlanta. However, the pace of investor sales has decreased by half in the last year as reported by Redfin. The market has slowed a bit in recent months as higher interest rates negatively impact ROI. However, the housing supply still can’t keep up with demand thus home prices are still increasing. Combining this with strong population growth in metro Atlanta, the market is still on track to show appreciation into 2024 for most segments.

DSCR loans have helped investors streamline the financing process and move quickly on deals that have strong potential. The main benefit of DSCR is that the investor doesn’t qualify based on their income or debt-to-income ratios. Many investors are self-employed and find the income documentation required by conventional bank financing a major obstacle. DSCR eliminates the need for paystubs, tax returns, and even employment requirements. This program is based more on the borrower’s credit and cash flow generated from rent payments.

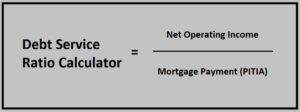

DSCR is calculated by taking the net operating income (NOI) generated by the property and dividing it by the proposed mortgage payments. The higher the ratio, the better chances of approval. This is a great way for investors to acquire properties without having to worry about their personal finances or employment history.

Example: Let’s assume investor Mary wants to purchase a short-term Airbnb rental property in Marietta. The monthly PITI payment on her new loan will be $2,550 per month. Mary is pretty confident the property will rent for the same amount of $2,550. So if we simply divide the rental income by the debt service amount we get x1.0

Example: Let’s assume investor John wants to purchase a long-term rental property in Alpharetta. The monthly PITI payment on his new loan will be $2,750 per month. John is pretty confident the property will rent for $3,300 per month. So if we divide the rental income by the debt service amount we get x1.2.

Note: payment amounts should include principal, interest, taxes, insurance, and HOI if required. Not included are property management fees, utilities, etc. Most lenders consider anything over x1.0 to be good. Obviously the higher the DSCR, the greater ROI for the investors and the lower risk to the lender.

Down payment requirements are often formulated based on the DSCR and the investor’s credit profile. Most purchase transactions require at least a 20% down payment. Cash-out refinances are permitted up to 75% loan-to-value.

Please note, these LTV limits are greatly influenced by many factors. Negative cash-flow DSCR options below 1.0 are even available for investors with a sizable 30%+ down payment and great credit scores. Please be sure to check the DSCR Purchase Page for the most up-to-date requirements.

DSCR loans offer several benefits to investors, such as:

- Maximizing your leverage: DSCR loans often allow you to borrow more money than traditional bank loans, which can help you acquire more assets or invest in larger projects. Again, personal income is not considered for qualifying.

- No limit on the number of properties financed: DSCR allows investors to scale their business with an unlimited number of loans. Most conforming loans have a limit of 10 properties financed.

- Close in name LLC: Many standard bank loans do not permit investors to close in name of an LLC. This can be very important for liability and tax purposes. *Please ensure you check with your legal and tax professional regarding the best form to close in*

- Ability to refinance short-term hard money loans: DSCR loans allow you to refinance out of a short-term hard money loan as long as it meets the debt service coverage ratio requirement. Furthermore, there are no loan seasoning requirements for cash-out refinance.

Investors that want to learn more about DSCR can connect with us 7 days a week by calling the number above, or just submit the Quick Call Form. We are happy to serve Investors throughout Georgia including. Stone Mountain, Kennesaw, Sandy Springs, Roswell, and Duluth