Destin has remained a popular vacation destination for decades, known for its stunning white sand beaches and emerald waters. But beyond its postcard-perfect scenery, this Florida gem also offers a variety of unique opportunity for real estate investors. DSCR or “Debt Service Coverage Ratio” loans have help provide investors with the necessary financing to make their dreams of owning property in Okaloosa County a reality.

Destin has remained a popular vacation destination for decades, known for its stunning white sand beaches and emerald waters. But beyond its postcard-perfect scenery, this Florida gem also offers a variety of unique opportunity for real estate investors. DSCR or “Debt Service Coverage Ratio” loans have help provide investors with the necessary financing to make their dreams of owning property in Okaloosa County a reality.

With Destin’s popularity as a vacation destination, there is a high demand for short-term rentals. This means that investors can potentially generate higher rental income compared to long-term rentals in other areas. And with DSCR loans taking into account this potential income, investors can secure larger loan amounts and make bigger investments in the lucrative Florida real estate market.

How Do DSCR Loans Work?

One of the main advantages of DSCR purchase loans is their flexibility. Unlike traditional mortgages, which are based solely on personal credit and income, DSCR loans take into account the potential income from rental properties. This is especially helpful for self-employed entrepreneurs, that may have issues documenting their personal income though traditional tax returns & W2s needed to qualify for conventional mortgages.

With DSCR loans, the focus is on the cash flow and potential income of the rental property itself, rather than solely on the borrower’s personal finances.

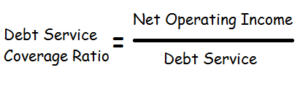

When evaluating a loan application for a DSCR loan, lenders will look at a few key factors. The first is the Debt Service Coverage Ratio (DSCR), which is calculated by dividing the annual net operating income (NOI) of a rental property by its annual debt service (mortgage payments). Lenders typically require a minimum DSCR of 1.0X to approve a loan, meaning that the property must generate enough income to cover 100% of its mortgage payments.

However, new options have emerged that permit DSCR as low as 0.5X for investors that have sizable down payments. Down payment amounts often start at 20% for most DSCR products. Loan to value (LTV) measures the amount of debt compared to the value of the rental property. Many lenders look for LTV ratios between 75-80%, which means they may be willing to lend up to 75-80% of the total value of the property.

In addition to these key factors, lenders will also examine the borrower’s credit score and history, as well as their experience as a real estate investor. Having a strong credit score and a proven track record of successful investments can greatly increase a borrower’s chances of securing a DSCR loan.

DSCR Loan Benefits:

DSCR Loan Benefits:

DSCR loans offer many advantages for investors:

- Rates and fees are generally much lower when compared to hard money loan programs

- No cap on the number of properties financed

- Close in name of LLC or Corp (not permitted with conventional loans)

- No tax returns, pay stubs, income docs, or employment is needed

- Regular DSCR loans from $100,000 – $1,000,000

- DSCR jumbo loan amounts up to $4 million

- Maximum Loan to Value (LTV) is 80% on purchase transactions and 75% for cash-out refinance transactions

- Single Family Homes, Condominiums, and 2-8 unit multifamily homes are all eligible for financing. Short-term rentals like Airbnb, VRBO, etc.

- Gift funds are eligible, but investors should have at least 5% of their own funds in the purchase

- First Time investors are permitted

- No hard credit pulls

- 30 and 15 Year fixed interest rate along with all the common 5/7/10 year ARM options

- Interest Only (IO) is available

- 2-1 buy down interest rate feature available

- DSCR Cash-out refinance transactions up to $2 million

- Standard rate-term refinance transactions available, hard money refinance eligible

Investors that want to learn more about getting approved can contact us 7 days a week by calling the number above, or just submit the Quick Call Form on this page.