Charlotte has become a popular location for real investors in recent years. With a surging population and diverse economy, it’s no wonder that Charlotte is on the rise as a notable hub for investment. Thanks to its continued growth in recent years, the market is ripe with potential, particularly for those considering long-term and short-term rental properties.

Charlotte has become a popular location for real investors in recent years. With a surging population and diverse economy, it’s no wonder that Charlotte is on the rise as a notable hub for investment. Thanks to its continued growth in recent years, the market is ripe with potential, particularly for those considering long-term and short-term rental properties.

For investors looking to capitalize on this growing market, Debt Service Coverage Ratio (DSCR) loans present a unique financial tool tailored to the needs of real estate investment. In this post, we’ll explore what DSCR loans are, how they work, and why Charlotte is the ideal landscape for your real estate portfolio.

What Is a DSCR Loan?

DSCR loan is a type of mortgage specifically designed for investment properties. Unlike traditional loans, which require extensive personal financial documentation to get approved, DSCR loans focus primarily on the cash flow generated by the property.

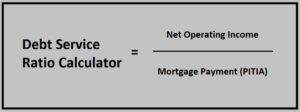

Here’s how it works: The DSCR is calculated by dividing the property’s annual net operating income (NOI) by its annual mortgage debt service (principal and interest payments). If the property brings in enough revenue to cover its mortgage and other costs, you, as an investor, are likely to be approved for a DSCR loan.

These loans are particularly attractive because they allow investors to leverage a property’s income potential, rather than their personal debt-to-income ratio. That means no income documentation, tax returns, etc are needed to get approved for financing. This opens up doors for investors who may be self-employed, have variable incomes, or hold multiple mortgages that might otherwise complicate a traditional loan application.

*Please learn more about the DSCR qualifying criteria on the Purchase page above.

Why DSCR for Investments in Charlotte?

1. Economic Growth: Charlotte’s economy is diverse and robust, boasting sectors such as finance, technology, and energy. This economic stability translates to more jobs and a steady influx of workers and families needing housing.

2. Growing Population: The city’s population has been steadily climbing, making it one of the fastest-growing metro areas. More people means greater demand for housing, and a well-chosen investment property can enjoy high occupancy rates and increasing rental income.

3. Favorable Rental Market: Both the long-term and short-term rental Airbnb, VRBO, markets in Charlotte remain strong. The city’s attractions, amenities, and business opportunities create a constant demand for rentals.

Investing in Charlotte with a DSCR Loan

Identifying Opportunities

Do your homework to identify neighborhoods with the best growth potential. Charlotte has many up-and-coming areas that could be lucrative for real estate investment.

Short-Term vs. Long-Term Rentals

Decide if you’re more interested in the immediate higher income from short-term rentals or the stability of long-term tenants. The right DSCR loan will support either strategy.

Working with Experts

Consider working with real estate experts and lenders specializing in DSCR loans to help find the best deals and streamline the financing process. Have questions or need assistance? Please connect with today to speak with a specialist.

DSCR Refinance

DSCR Refinance

DSCR loans can provide a valuable refinance option for those investors looking to refinance short term hard money loans. Both rate-term and DSCR cash-out options are available. With a lower interest rate and longer-term, investors can potentially save money on monthly payments and improve cash flow. Please see the DSCR refinance page for more details.

Flexible Repayment Terms

The repayment terms for DSCR loans can vary depending on the lender and the specific loan program. Some lenders offer flexible options such as interest-only payments or balloon payments at the end of the term. It’s important to carefully consider these repayment terms when choosing a DSCR loan to ensure it aligns with your investment strategy.

Conclusion

DSCR loans are one such tool, offering flexibility and reliance on property performance rather than personal financial history. Whether you’re eyeing your first investment property or looking to add to a growing portfolio, DSCR loans are a tool worth considering.

Ready to take the next step in your real estate investment career? Connect with us today by submitting the Quick Call Form on this page and subscribe to our blog for more insights.