Are you an investor looking to purchase a long-term or short-term rental property in Charleston? One type of loan that you may want to consider is the DSCR (debt service coverage ratio) loan. In this blog post, we’ll discuss what DSCR loans are and the pros and cons of using them to finance your rental purchase in South Carolina.

Are you an investor looking to purchase a long-term or short-term rental property in Charleston? One type of loan that you may want to consider is the DSCR (debt service coverage ratio) loan. In this blog post, we’ll discuss what DSCR loans are and the pros and cons of using them to finance your rental purchase in South Carolina.

Current Real Estate Rental Market in Charleston:

Charleston has continued to show strength in the housing market with a median home price of $530,000, this is actually up 4% year over year according to Zillow. The average days on the market is just over 1 month, showing that the market is still moving quickly. However, mortgage interest rates have continued to increase and how this will impact the market in 2024 is yet to be known.

What are DSCR loans?

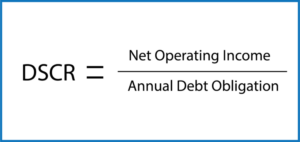

DSCR (Debt Service Coverage Ratio) loans are popular in the investor rental space since the qualifying process focuses more on the property itself instead of the borrower. These loans calculate the property’s debt service coverage ratio, which indicates whether they can cover the monthly debt service – mortgage payment.

DSCR loans can be an excellent choice for those investors that are self-employed, have commission-based income, or own multiple investment properties. This program does not require any of the traditional income or employment documentation that is required for conventional loans.

Pros of using DSCR Loans:

- Less stringent underwriting: Unlike traditional lenders, DSCR loans don’t evaluate borrowers based solely on their credit score or debt-to-income ratio. In fact, no income, tax returns, or employment documentation is needed for approval. Instead, lenders focus on the cash flow of the property, which means borrowers with lower credit scores or higher debt-to-income ratios can still qualify. Please read the DSCR Purchase Page for more information.

- DSCR loans can be closed in the name of an LLC. This is often not possible with standard conventional bank loans.

- Higher loan limits: Due to the focus on cash flow instead of borrowers’ income, those looking to buy higher-priced investment properties may have an easier time getting approved for a DSCR loan.

- Interest-only options are available that help maximize ROI.

- Flexibility: DSCR loans can be used for a variety of long-term and short-term rental properties like Airbnb and VRBO. Property types include single-family homes, multi-family homes, duplexes, and condos. *Primary residences are not permitted with DSCR.

- Flexible rate-term and cash-out refinance options, this is helpful for investors practicing the BRRRR method. Or helpful for investors that have short-term hard money loans that are due.

Cons of DSCR Loans:

- Higher interest rates: DSCR loans typically come with slightly higher interest rates when compared to traditional loans because they present a higher risk for the lender.

- Pre-payment penalty: DSCR loans usually have a pre-prepayment penalty of 2-4 years. However, there are often options to “buy down” and reduce this.

- Limited availability: Because DSCR loans are more niche than traditional loans, they may not be offered by all lenders.

- Possible higher down payment requirement: Lenders may require a larger down payment when using a DSCR loan than with traditional financing options. Some options are available up to 80% LTV depending on the DSCR factor.

DSCR loans are a great option for those looking to finance a property purchase in Charleston, particularly if they have an irregular source of income. Overall, the Charleston real estate market presents many opportunities for homebuyers and investors alike, and DSCR loans can be a valuable tool to help them make investment a profitable reality.

DSCR loans are a great option for those looking to finance a property purchase in Charleston, particularly if they have an irregular source of income. Overall, the Charleston real estate market presents many opportunities for homebuyers and investors alike, and DSCR loans can be a valuable tool to help them make investment a profitable reality.

Investors that want to learn more about DSCR purchase and refinance options are encouraged to contact us 7 days a week by calling the number above, or just submit the Quick Call Form here.